Bild 1 von 24

Galerie

Bild 1 von 24

World Scientific Reference On Contingent Claims Analysis In Corporate Finance

US $674,99

Ca.EUR 581,89

oder Preisvorschlag

Bisher US $899,99 (- 25%)

Artikelzustand:

Oops! Looks like we're having trouble connecting to our server.

Refresh your browser window to try again.

Versand:

US $11,22 (ca. EUR 9,67) USPS Media MailTM.

Standort: New Haven, Connecticut, USA

Lieferung:

Lieferung zwischen Mo, 27. Okt und Sa, 1. Nov nach 94104 bei heutigem Zahlungseingang

Rücknahme:

30 Tage Rückgabe. Käufer zahlt Rückversand. Wenn Sie ein eBay-Versandetikett verwenden, werden die Kosten dafür von Ihrer Rückerstattung abgezogen.

Zahlungen:

Sicher einkaufen

- Gratis Rückversand im Inland

- Punkte für jeden Kauf und Verkauf

- Exklusive Plus-Deals

Der Verkäufer ist für dieses Angebot verantwortlich.

eBay-Artikelnr.:395459766513

Artikelmerkmale

- Artikelzustand

- ISBN

- 9789814730723

Über dieses Produkt

Product Identifiers

Publisher

World Industries Scientific Publishing Co Pte LTD

ISBN-10

9814730726

ISBN-13

9789814730723

eBay Product ID (ePID)

236817132

Product Key Features

Book Title

Contingency Approaches to Corporate Finance: a World Scientific Reference (in 4 Volumes)

Number of Pages

1200 Pages

Language

English

Topic

Banks & Banking, Corporate Finance / Valuation, Corporate Finance / General

Publication Year

2017

Illustrator

Yes

Genre

Business & Economics

Book Series

World Scientific Handbook in Financial Economics Ser.

Format

Hardcover

Dimensions

Item Weight

0.1 Oz

Additional Product Features

Intended Audience

Trade

LCCN

2018-029186

Synopsis

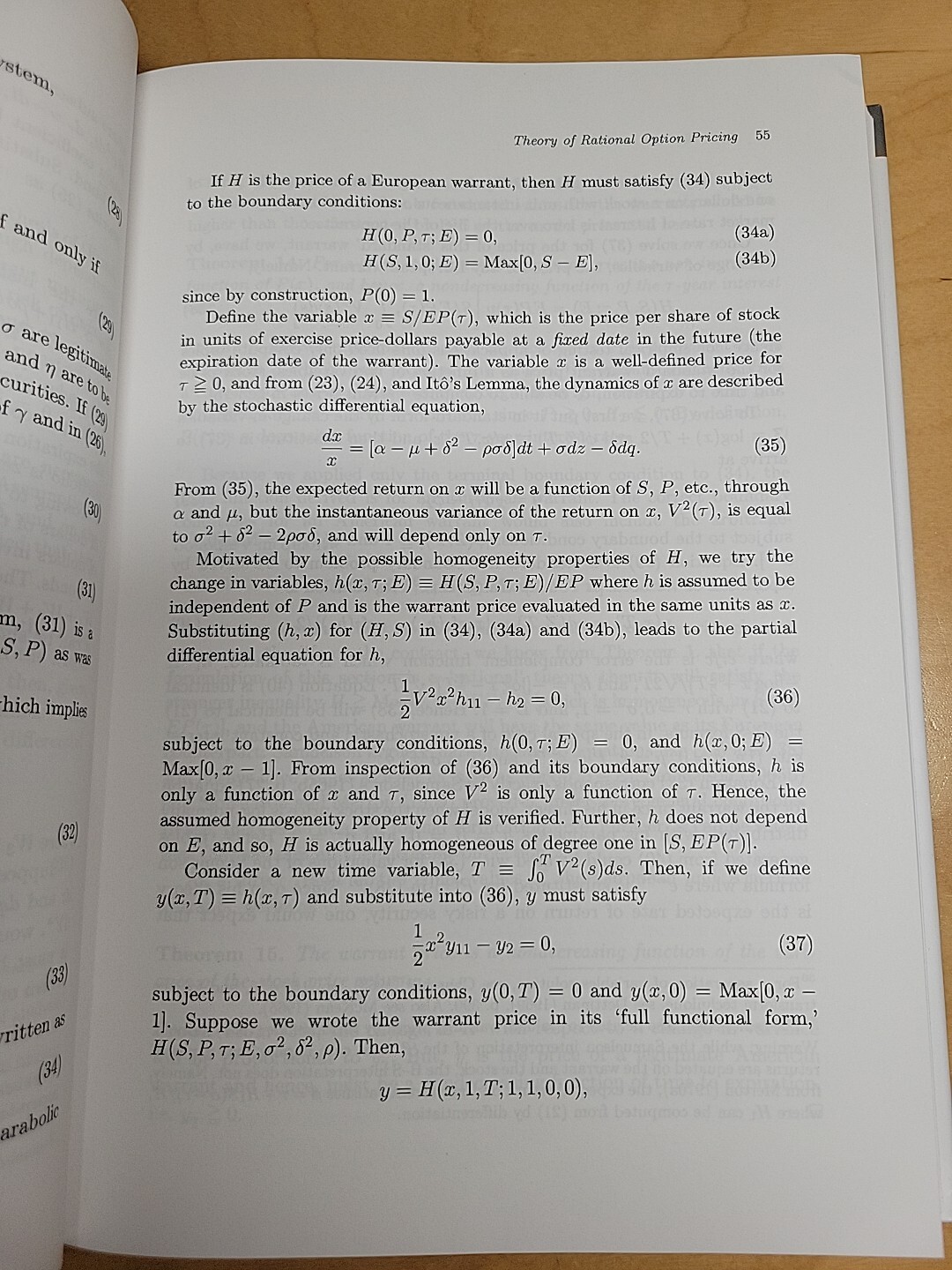

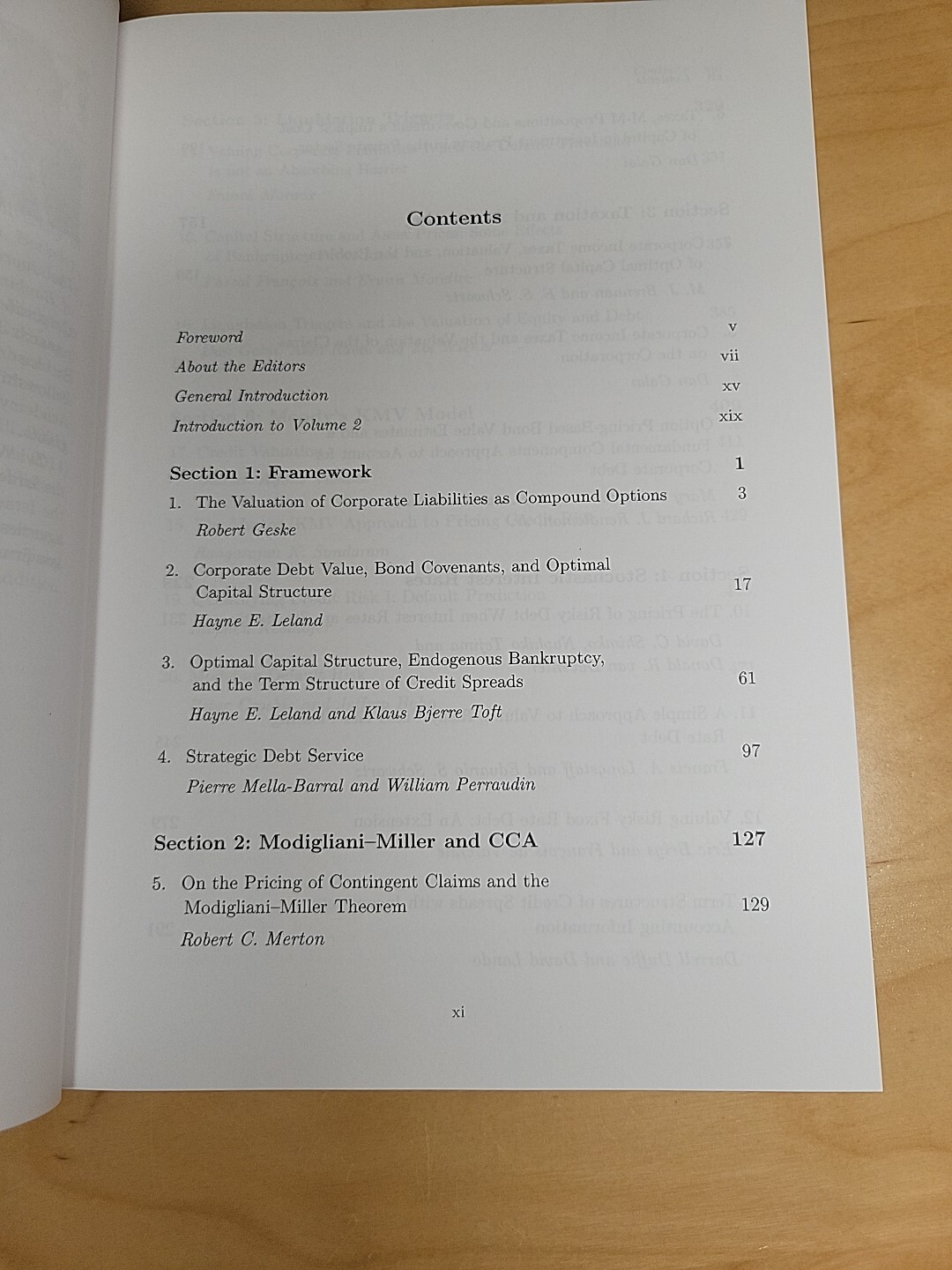

Black and Scholes (1973) and Merton (1974) (hereafter referred to as BSM) introduced the contingent claim approach (CCA) to the valuation of corporate debt and equity. The BSM modeling framework is also named the "structural" approach to risky debt valuation. The CCA approach considers all stakeholders of the corporation as holding contingent claims on the assets of the corporation. Each claim holder has different priorities, maturities and conditions for payouts. It is based on the principle that all the assets belong to all the liability holders.In the structural approach the arrival of the default event relies on economic arguments for why firms default as it is explicitly related to the dynamics of the economic value of the firm. A standard structural model of default timing assumes that a corporation defaults when its assets drop to a sufficiently low level relative to its liabilities.The BSM modeling framework gives the basic fundamental version of the structural model where default is assumed to occur when the net asset value of the firm at the maturity of the pure-discount debt becomes negative, i.e., market value of the assets of the firm falls below the market value of the firm's liabilities. In a regime of limited liability, the shareholders of the firm have the option to default on the firm's debt. Equity can be viewed as a European call option on the firm's assets with a strike price equal to the face value of the firm's debt. Actually, CCA can be used to value all the components of the firm's liabilities. Option pricing models are used to value stocks, bonds, and many other types of corporate claims.Different versions of the model correspond to different assumptions about the conditions when a firm defaults. Merton (1974) assumes that the firm only defaults at the maturity date of the firm's outstanding debt when the net asset value of the firm, in market value terms, is negative. Others introduce other conditions for default. Also, different authors introduce more complicated capital structure with different kinds of bonds (e.g. senior and junior), warrants, corporate taxes, ESOP, and more. Volume 1: Foundations of CCA and Equity ValuationVolume 1 presents the seminal papers of Black and Scholes (1973) and Merton (1973, 1974). This volume also includes papers that specifically price equity as a call option on the corporation. It introduces warrants, convertible bonds and taxation as contingent claims on the corporation. It highlights the strong relationship between the CCA and the Modigliani-Miller (M&M) Theorems, and the relation to the Capital Assets Pricing Model (CAPM). Volume 2: CCA Approach to Corporate Debt ValuationVolume 2 concentrates on corporate bond valuation by introducing various types of bonds with different covenants as well as introducing various conditions that trigger default. While empirical evidence indicates that the simple Merton's model underestimates the credit spreads, additional risk factors like jumps can be used to resolve it. Volume 3: Issues in Corporate Finance with CCA ApproachVolume 3 includes papers that look at issues in corporate finance that can be explained with the CCA approach. These issues include the effect of dividend policy on the valuation of debt and equity, the pricing of employee stock options and many other issues of corporate governance. Volume 4: CCA Approach to Banking and Financial IntermediationVolume 4 focuses on the application of the contingent claim approach to banks and other financial intermediaries. Regulation of the banking industry led to the creation of new financial securities (e.g., CoCos) and new types of stakeholders (e.g., deposit insurers)., Black and Scholes (1973) and Merton (1973, 1974) (hereafter referred to as BSM) introduced the contingent claim approach (CCA) to the valuation of corporate debt and equity. The BSM modeling framework is also named the 'structural' approach to risky debt valuation. The CCA considers all stakeholders of the corporation as holding contingent claims on the assets of the corporation. Each claim holder has different priorities, maturities and conditions for payouts. It is based on the principle that all the assets belong to all the liability holders.The BSM modeling framework gives the basic fundamental version of the structural model where default is assumed to occur when the net asset value of the firm at the maturity of the pure-discount debt becomes negative, i.e., market value of the assets of the firm falls below the face value of the firm's liabilities. In a regime of limited liability, the shareholders of the firm have the option to default on the firm's debt. Equity can be viewed as a European call option on the firm's assets with a strike price equal to the face value of the firm's debt. Actually, CCA can be used to value all the components of the firm's liabilities, equity, warrants, debt, contingent convertible debt, guarantees, etc.In the four volumes we present the major academic research on CCA in corporate finance starting from 1973, with seminal papers of Black and Scholes (1973) and Merton (1973, 1974). Volume I covers the foundation of CCA and contributions on equity valuation. Volume II focuses on corporate debt valuation and the capital structure of the firm. Volume III presents empirical evidence on the valuation of debt instruments as well as applications of the CCA to various financial arrangements. The papers in Volume IV show how to apply the CCA to analyze sovereign credit risk, contingent convertible bonds (CoCos), deposit insurance and loan guarantees. Volume 1: Foundations of CCA and Equity ValuationVolume 1 presents the seminal papers of Black and Scholes (1973) and Merton (1973, 1974). This volume also includes papers that specifically price equity as a call option on the corporation. It introduces warrants, convertible bonds and taxation as contingent claims on the corporation. It highlights the strong relationship between the CCA and the Modigliani-Miller (M&M) Theorems, and the relation to the Capital Assets Pricing Model (CAPM). Volume 2: Corporate Debt Valuation with CCAVolume 2 concentrates on corporate bond valuation by introducing various types of bonds with different covenants as well as introducing various conditions that trigger default. While empirical evidence indicates that the simple Merton's model underestimates the credit spreads, additional risk factors like jumps can be used to resolve it. Volume 3: Empirical Testing and Applications of CCAVolume 3 includes papers that look at issues in corporate finance that can be explained with the CCA approach. These issues include the effect of dividend policy on the valuation of debt and equity, the pricing of employee stock options and many other issues of corporate governance. Volume 4: Contingent Claims Approach for Banks and Sovereign DebtVolume 4 focuses on the application of the contingent claim approach to banks and other financial intermediaries. Regulation of the banking industry led to the creation of new financial securities (e.g., CoCos) and new types of stakeholders (e.g., deposit insurers).

LC Classification Number

HG4026.C6236 2018

Artikelbeschreibung des Verkäufers

Info zu diesem Verkäufer

Bibliomaniacs Anonymous

100% positive Bewertungen•411 Artikel verkauft

Angemeldet als privater VerkäuferDaher finden verbraucherschützende Vorschriften, die sich aus dem EU-Verbraucherrecht ergeben, keine Anwendung. Der eBay-Käuferschutz gilt dennoch für die meisten Käufe. Mehr erfahrenMehr erfahren

Verkäuferbewertungen (116)

- s***s (696)- Bewertung vom Käufer.Letzter MonatBestätigter KaufExcellent packaging and quick receipt of item as described. Thank you!

- g***e (80)- Bewertung vom Käufer.Letzter MonatBestätigter KaufThis book shipped to me rapidly and it was carefully packaged. Thanks, it arrived in excellent condition, and I am happy with the value, appearance and quality of the book. (I have to confess, though, I haven't started reading yet -- it's on the bookshelf waiting for a quiet rainy day...)

- o***o (869)- Bewertung vom Käufer.Letztes JahrBestätigter KaufAbsolutely amazing seller. Just a perfectly packed and protected book that came as described. Everything is just perfect. Many kind thanks again!Luzzato's Ethico-Psychologic Interpretation Of Judaism Noah Rosenbloom (Nr. 393970733947)